Tax Advisory Services

Tax Minimization services in Las Vegas, NV

At Cornerstone Tax Advisory, we take an integrated approach to financial planning that includes tax minimization strategies. Taxes are one of the single largest expenses we have, yet we spend little time considering the impact they have on our financial plan. Every financial move you make has tax implications, so having a comprehensive retirement plan with tax-smart investment strategies is vital.

Typical Client Journey

Tax Assessment and Planning

Develop a personalized tax strategy to minimize tax liability while complying with tax laws

Tax Compliance

Ensure compliance with changing tax regulations and optimize deductions and credits

Ongoing Tax Monitoring and Adjustments

Continuously monitor changes in your financial situation and tax laws. Make proactive adjustments to your tax strategy as needed to adapt to life events and financial goals

Our Tax Advisory Focus

The main goal of tax planning is to generate tax diversification. Whether it is income taxes, capital gain taxes, or estate taxes, our team will assess your tax liabilities and develop strategies to minimize what you will pay in taxes when it comes time to retire. We will review the taxable nature of our current holdings and recommend strategies to reduce your tax burden through the use of retirement accounts such as an IRA or Roth IRA. At Cornerstone Tax Advisory, we will go as far as to develop tax strategies for passing on your wealth to your beneficiaries.

Our focus is to find ways to put more money back into our clients’ pockets. There are many opportunities to accomplish this when your retirement planning is bundled and managed by the same firm. We believe that increasing your tax efficiency can be achieved when aligning investment management, retirement planning, and estate planning under one roof.

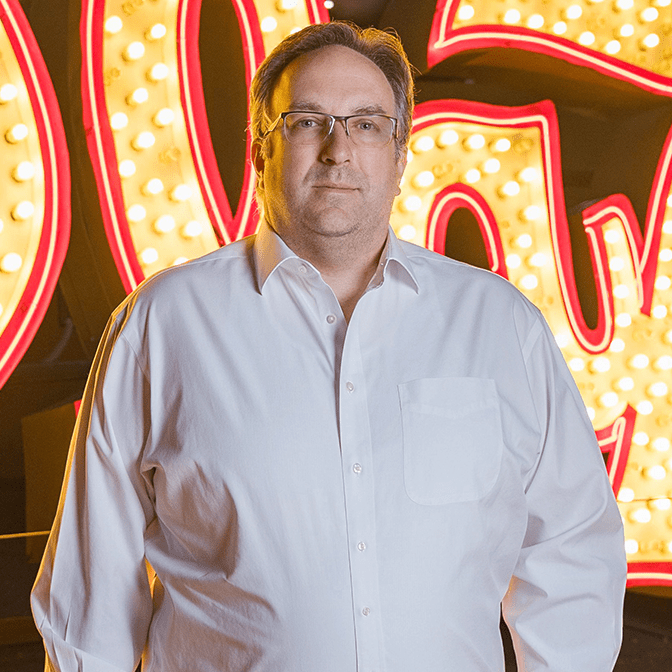

Meet Chris, Las Vegas Tax Expert

Christopher (Chris) Pepper, E.A. has over 15 years of tax experience working in national firms and more recently with a large family office with over $4 billion in assets. Over his career, he has worked with high-net-worth individuals, family offices, partnerships, and S-Corporations. He provides forward-thinking planning and consulting to meet the financial goals and objectives of his clients.

As a licensed Enrolled Agent, Chris is available to handle matters and strategies around planning for income, estate, gift, payroll, inheritance, non-profit, and retirement taxes. The Enrolled Agent status is the highest accredited designation the IRS can award. Originally from New York, Chris graduated from CW Post – Long Island University in 2004, where he was president of Beta Alpha Psi. After college, Chris went to work at one of Long Island’s largest CPA firms focusing on a wide range of industries. After relocating to Philadelphia, he settled in Henderson, NV in 2012 where he lives with his wife and three children.

Tax Advisory & Tax Planning

FREQUENTLY ASKED QUESTIONS

What do Tax Advosrs do?

A tax advisor plays a crucial role in helping individuals and businesses navigate complex tax codes. They provide expert guidance on tax planning, compliance, and strategies to minimize tax liabilities while ensuring full adherence to tax laws.

Why should I use Tax Advisory Services?

Hiring a tax advisor offers several benefits. They have in-depth knowledge of tax laws and regulations, helping you maximize deductions and credits. They also save you time, reduce the risk of errors, and provide peace of mind that your taxes are handled professionally.

Can a Tax Advisor help with tax planning for retirement?

Yes, tax advisors specialize in tax-efficient retirement planning. They can help you make strategic decisions about retirement account contributions, withdrawals, and investments to minimize taxes during retirement and ensure financial security.

What types of clients benefit from Tax Advisory services?

Tax advisory services benefit individuals, small businesses, corporations, and anyone seeking to optimize their tax situation. Whether you’re planning for retirement, managing investments, or dealing with complex tax issues, a tax advisor can provide tailored solutions to meet your needs.

Tax Planning Articles

Strategies to Manage Your Wealth Estate planning can be complex, both from a legal and financial perspective, as well as a personal one. Considering the end of your life can be a challenging process, but it’s an important step if you want to make sure your assets are distributed according to

Have you been considering the impact taxes will have on your retirement savings? Have you been strategic in managing the effect taxes may have on your financial future? If you answered no to either of these questions, you may want to take a look at the following tax

We’re coming up on the end of the year, and while it’s a time to take a break and enjoy the holiday season, it’s also a good time to consider tax strategies that may benefit you. Because taxes are calculated from January 1st to December 31st of each year, and